Checkbook Chronicles

Checkbook Chronicles is a series of profiles highlighting the financial realities of everyday Americans.

Balancing a fixed income with inflation, a Georgia retiree feels stuck

Nancy Breland, 72, is trying to figure out how to cope with rising prices, including for home insurance.

Living off $2,400 a month, a 71-year-old widow tries to get by despite rising prices

Lucy Haverfield of Alva, Florida, has struggled with inflation driving up the costs of daily essentials. “I thought my 60s were going to be my golden years," she said.

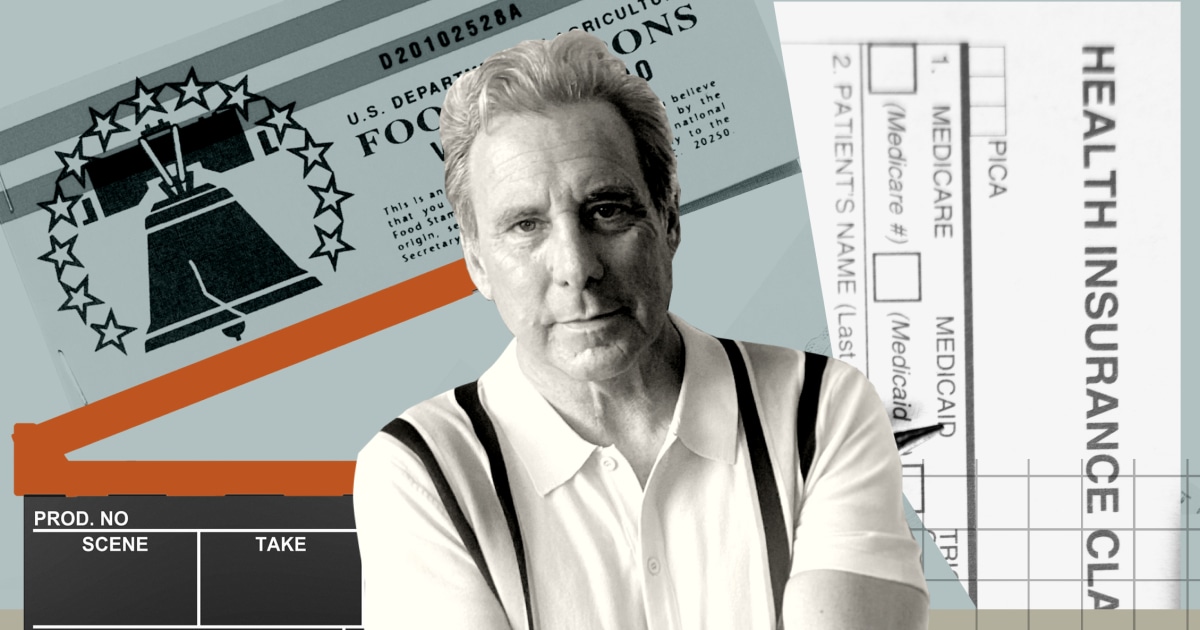

He plays rich on screen but dreams of full-time work: 'Why can’t I get a living wage?'

Doug Sharp has a business degree and drove for Lyft and Uber, but steady work has been hard to come by.