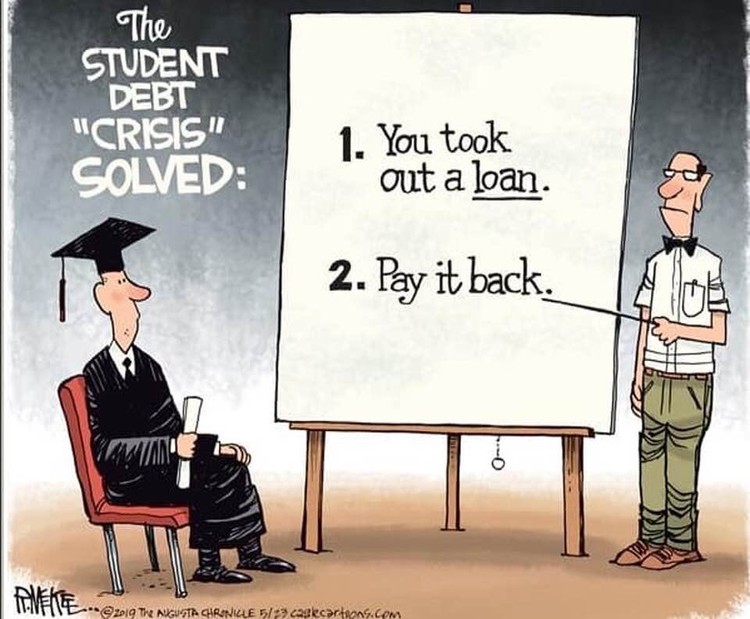

In principle, You should pay what you owe, I agree, I believe people should pay their mortgages, car loans, personal loans.

BUT

I'm sorry, an education should not hinge on loans.

In regards to colleges, the educational institutions and banks preyed upon young men and women who were programmed to believe that a college education was THE only way to get anywhere in life. Kids are shamed into believing that going to community or state college was not the smart way to go about it (that trend is changing) and that they had to go to the USC's & NYU's to be acknowledged after graduating. You cannot fault a kid for getting an engineering degree from a top school only to find out it that it's got a lot more to do with who you know (in many cases) than what school you went to or what GPA you had. When I hire kids, I don't give a FUCK about what school they went too nor do I put a major emphasis on GPA (don't get me wrong, don't like to see below a 2.75); it's about their character and how hungry they are because they will be learning all over again when it comes to the professional environment. While others, unfortunately ,hire on personal preference, references, etc.

This needs to be resolved and Universities & Banks need to be checked in the future. Tuitions should not be inflated and be kept in check. Loans should not be accruing interest during a students tenure, loans should not have exorbitant interest rates, and Private loan payments need to be flexible when it comes to a young adult's income fresh out of school ( don't expect a kid to pay 1,200 a month when they make 50,000 living in or near cities)

IMHO, This situation with Student Debt is 100% on the Education Institutions & Banks; as well as the Government for not checking on the greed of the former.

BUT

I'm sorry, an education should not hinge on loans.

In regards to colleges, the educational institutions and banks preyed upon young men and women who were programmed to believe that a college education was THE only way to get anywhere in life. Kids are shamed into believing that going to community or state college was not the smart way to go about it (that trend is changing) and that they had to go to the USC's & NYU's to be acknowledged after graduating. You cannot fault a kid for getting an engineering degree from a top school only to find out it that it's got a lot more to do with who you know (in many cases) than what school you went to or what GPA you had. When I hire kids, I don't give a FUCK about what school they went too nor do I put a major emphasis on GPA (don't get me wrong, don't like to see below a 2.75); it's about their character and how hungry they are because they will be learning all over again when it comes to the professional environment. While others, unfortunately ,hire on personal preference, references, etc.

This needs to be resolved and Universities & Banks need to be checked in the future. Tuitions should not be inflated and be kept in check. Loans should not be accruing interest during a students tenure, loans should not have exorbitant interest rates, and Private loan payments need to be flexible when it comes to a young adult's income fresh out of school ( don't expect a kid to pay 1,200 a month when they make 50,000 living in or near cities)

IMHO, This situation with Student Debt is 100% on the Education Institutions & Banks; as well as the Government for not checking on the greed of the former.